Fatca Form Mashreq 2015

What is the Fatca Form Mashreq

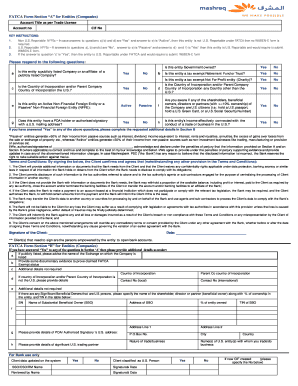

The Fatca form Mashreq is a document required for compliance with the Foreign Account Tax Compliance Act (FATCA). This form is essential for U.S. taxpayers who have financial accounts outside the United States, particularly in banks like Mashreq Bank. The purpose of the form is to report information about foreign financial accounts and ensure that U.S. citizens meet their tax obligations. By submitting this form, individuals help prevent tax evasion and comply with international tax laws.

How to use the Fatca Form Mashreq

Using the Fatca form Mashreq involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding your foreign financial accounts, including account numbers and balances. Next, download the form from the official Mashreq Bank website or obtain a copy from your local branch. Fill out the form carefully, ensuring that all details are correct. Once completed, you can submit the form electronically or via mail, depending on the bank's submission guidelines.

Steps to complete the Fatca Form Mashreq

Completing the Fatca form Mashreq requires careful attention to detail. Follow these steps:

- Download the Fatca form Mashreq from the official source.

- Provide your personal information, including your name, address, and taxpayer identification number.

- List all foreign financial accounts, including the name of the bank, account numbers, and balances.

- Sign and date the form to certify that the information provided is accurate.

- Submit the form according to the guidelines provided by Mashreq Bank.

Legal use of the Fatca Form Mashreq

The legal use of the Fatca form Mashreq is critical for U.S. taxpayers with foreign accounts. This form must be completed accurately to comply with FATCA regulations. Failure to submit the form or providing incorrect information can lead to penalties and increased scrutiny from tax authorities. It is important to understand that the form serves as a declaration of your foreign financial interests and must be treated with the same seriousness as any tax-related document.

Required Documents

When filling out the Fatca form Mashreq, certain documents may be required to support your submission. These documents typically include:

- Proof of identity, such as a passport or driver's license.

- Account statements from foreign financial institutions.

- Taxpayer identification number (TIN) or Social Security number (SSN).

- Any previous correspondence with tax authorities regarding foreign accounts.

Form Submission Methods

The submission methods for the Fatca form Mashreq can vary based on the bank's policies. Generally, you have the option to submit the form electronically through the bank's online portal or to mail a physical copy to the designated address. Ensure that you follow the specific instructions provided by Mashreq Bank for the chosen method to avoid any delays in processing.

Quick guide on how to complete fatca form mashreq

Complete Fatca Form Mashreq effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow offers all the tools you require to create, edit, and eSign your documents promptly without delays. Manage Fatca Form Mashreq across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Fatca Form Mashreq with ease

- Obtain Fatca Form Mashreq and click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Mark important sections of your documents or conceal sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to store your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the risk of lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Fatca Form Mashreq to ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fatca form mashreq

Create this form in 5 minutes!

People also ask

-

What is the FATCA form PDF Mashreq and why is it important?

The FATCA form PDF Mashreq is a document required for compliance with the Foreign Account Tax Compliance Act, aimed at preventing tax evasion by U.S. citizens. It's important because it helps financial institutions to report the identification and financial information of U.S. account holders effectively.

-

How can airSlate SignNow help with completing the FATCA form PDF Mashreq?

airSlate SignNow simplifies the process of completing the FATCA form PDF Mashreq by providing a user-friendly platform to fill, sign, and send documents electronically. Our solution ensures that users can easily manage their compliance documentation without the hassle of traditional paper forms.

-

Is there a cost associated with using airSlate SignNow for the FATCA form PDF Mashreq?

Yes, airSlate SignNow offers various pricing plans tailored to the needs of businesses. Each plan provides a cost-effective solution for managing the FATCA form PDF Mashreq and other important documents, ensuring you only pay for the features you need.

-

What features does airSlate SignNow offer for managing the FATCA form PDF Mashreq?

airSlate SignNow provides features like customizable templates, electronic signatures, and cloud storage to efficiently manage the FATCA form PDF Mashreq. These tools allow for seamless collaboration and secure document handling, making compliance much easier.

-

Can I integrate airSlate SignNow with other software for FATCA form PDF Mashreq management?

Yes, airSlate SignNow offers integrations with various software applications, enhancing the management of the FATCA form PDF Mashreq. This integration capability ensures that you can streamline your workflow and maintain compliance without switching between multiple platforms.

-

How secure is airSlate SignNow when handling the FATCA form PDF Mashreq?

Security is a top priority at airSlate SignNow. We implement robust security measures, including encryption and access controls, to ensure that your FATCA form PDF Mashreq and other sensitive documents are handled securely and privately.

-

What benefits does using airSlate SignNow offer for processing FATCA form PDF Mashreq?

By using airSlate SignNow for processing the FATCA form PDF Mashreq, you can save time, reduce errors, and ensure compliance with legal requirements. The platform streamlines the document workflow, enabling quick and efficient approval processes.

Get more for Fatca Form Mashreq

- Ky discovery form

- Ky divorce form

- Kentucky corporate search form

- Ky 7 day notice form

- Kentucky assignment of mortgage by individual mortgage holder form

- Assignment mortgage corporate 481379648 form

- Kentucky notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial form

- Kentucky assignment form

Find out other Fatca Form Mashreq

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT